5 ways to streamline your self-assessment tax return

When is the self-assessment tax return deadline?

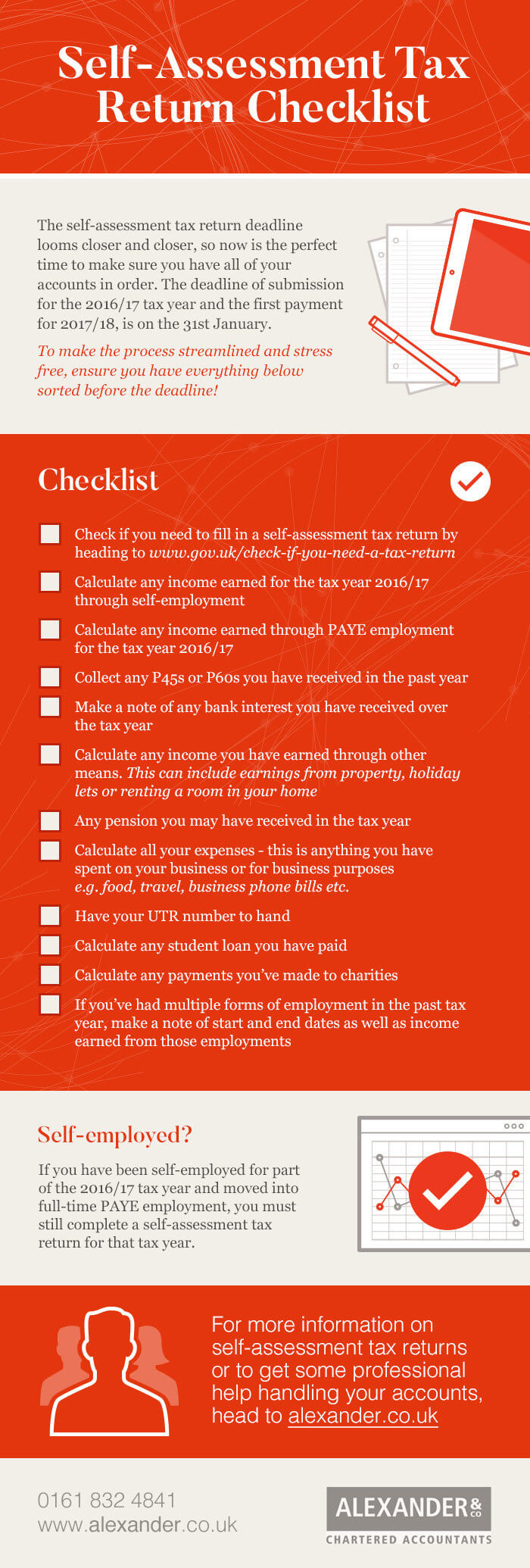

The self assessment tax return deadline is on January 31st 2018, making now a good time to start preparing for that all important cut off date.

If you have been self employed within the last year, have over £2500 in untaxed income, you earn over £100,000 or need to pay capital gains tax, in these cases you must complete a self-assessment tax return. There are also other factors that will ascertain whether you will need to send a tax return to HMRC. These can be found on the HMRC website or you can use their handy tool to check your eligibility.

You can save time, money and resources with proper planning and thorough streamlining of your self-assessment tax return well in advance. We’ve put together a 5 step guide detailing the best way to get ready for 2018’s tax return deadline.

Failure to complete your tax return on time will result in significant late penalty fees.

1. Register for HMRC’s online service

In order to submit your tax return online, you’ll need to make sure you’re registered for HMRC’s online service. It takes up to 10 working days for you to receive your activation code through the post, so it’s best not to leave this until the last minute.

In addition to this, you’ll need to have the following information ready:

- your ‘unique taxpayer reference’ (UTR) number

- National insurance number

- Postcode.

If you’ve filled in a self assessment tax return in the past, you’ll find all of this information on the relevant paperwork from HMRC. However, if this is your first tax return, you’ll need to wait for your UTR to arrive in the post.

Once you’re all signed up, you can either send your tax return via the HMRC website or through HMRC compliant software.

2. Start collecting the relevant information

Before sitting down to start your tax return, there are a few pieces of information that you should have to hand. Some of the documents you’ll need include:

- P60 – End of year certificate

- P11D – Expenses and benefits

- P45 – Details of employee leaving work

- P2 – Coding notice

- Bank interest certificates

- Details of income including money received from shares and properties

3. Keep accurate records

The key to getting taxed the correct amount, is keeping accurate records. This can save you having to spend time claiming a tax refund and prevent incurring any extra charges.

You can do this by keeping records of income and expenses, both physically and digitally. This includes receipts, statements and invoices, to name a few.

This way, you’ll have all the information you need at your fingertips when it comes to filling out your online self assessment tax return.

4. Don’t rush your return

Whilst you can make corrections to your self assessment tax return after it’s been sent, you can avoid having to do this by taking a slow and steady approach.

One of the advantages of filling out self assessment form online is that you can save where you’re up to and finish the rest later. This gives you a chance to check and collect any missing information before sending it to HMRC.

5. Find an experienced accountant

If you’re having difficulties with any part of the tax return process, it may be work getting professional self assessment advice from an experienced accountant.

Alexander and Co’s team of expert tax accountants can assist you with all areas of tax and can help you fill in your tax return accurately and efficiently.

For more information on how our services could benefit your business, visit our personal tax page or explore our bookkeeping services. Alternatively, you can fill in our contact form and our team will be in touch promptly.

Need a bit of help in the New Year to get your accountants in order? Why not get in touch with us to find our how our expert team of chartered accountants can help!

Quick Contact

We would love to hear from you. Please fill out this form and we will be in touch.