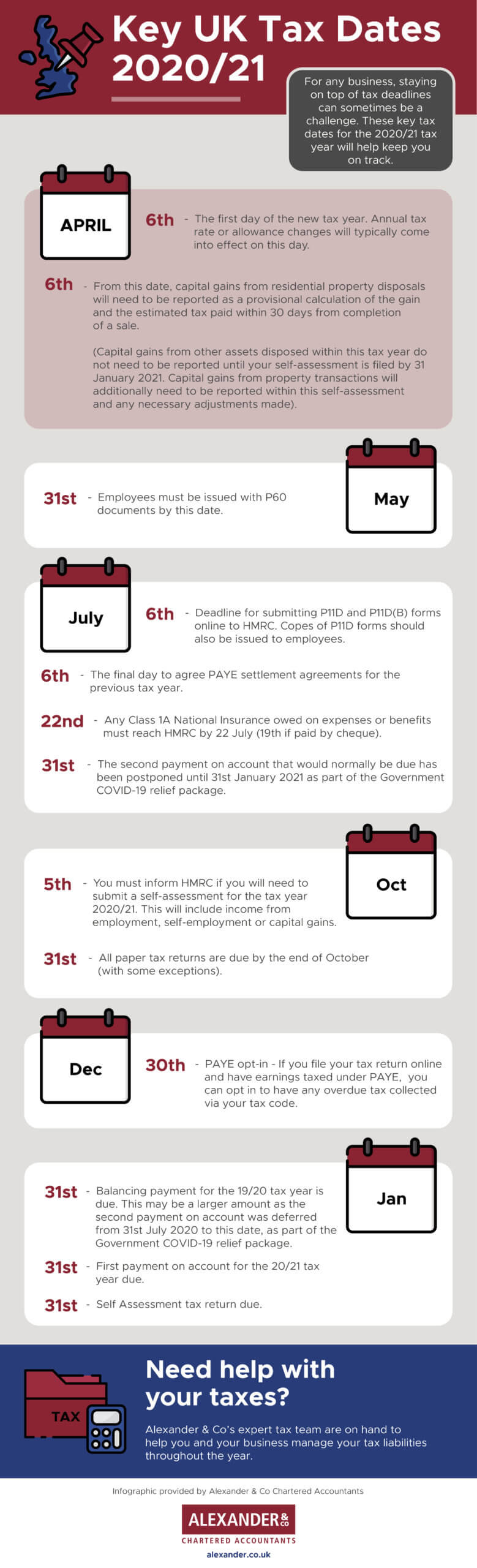

Important Tax Year 2020/21 Dates

With the recent COVID-19 outbreak appearing to have a significant impact on businesses, a few key accounting dates have been pushed back to support businesses during the pandemic. With this in mind, we’ve compiled a list of all important tax dates for the tax year 2020/21, to help your business prepare for the busy year ahead.

Save this handy infographic to your phone or bookmark this page to stay up-to-date. All tax year dates are also listed below our tax year infographic.

Supporting your business throughout this tax year

This tax year is set to be one of the most difficult for businesses across the UK. However, we’re here to support your business during this challenging time. For more information, visit our COVID-19 resource centre and call us on 0161 832 4841 or simply email info@alexander.co.uk.

Tax year 2020/21 dates for your diary

April 2020

- 6th – The first day of the new tax year. Annual tax rate or allowance changes will typically come into effect on this day.

- 6th – From this date, capital gains from residential property disposals sold from this date will need to be reported as a provisional calculation of the gain and the estimated tax paid within 30 days from completion of a sale.

- Capital gains from other assets disposed within this tax year do not need to be reported until your self-assessment is filed by 31 January 2021. Capital gains from property transactions will additionally need to be reported within this self-assessment and any necessary adjustments made.

May 2020

- 31st – Employees must be issued with P60 documents by this date.

July 2020

- 6th – Deadline for submitting P11D and P11D(B) forms online to HMRC. Copes of P11D forms should also be issued to employees.

- 6th – The final day to agree PAYE settlement agreements for the previous tax year.

- 22nd – Any Class 1A National Insurance owed on expenses or benefits must reach HMRC by 22 July (19th if paid by cheque).

- 31st – Second payments on account date for the 19/20 tax year are delayed due to the covid-19 outbreak.

October 2020

- 5th – You must inform HMRC if you will need to submit a self-assessment for the tax year 2020/21. This will include income from employment, self-employment or capital gains.

- 31st – All paper tax returns are due by the end of October (with some exceptions).

December 2020

- 30th – PAYE opt-in – If you file your tax return online and have earnings taxed under PAYE, you can opt in to have any overdue tax collected via your tax code.

January 2021

- 31th – Balancing payment for the 19/20 tax year due.

- 31st – First payment on account for the 20/21 tax year due.

- 31st – Self Assessment tax return due.