Important tax dates 2018

With the arrival of the new year comes a range of important tax dates and tax deadlines to remember. Regardless of whether you’re responsible for business or personal taxes, you’ll need to keep these dates to hand to comply with HMRC’s tax regulations and avoid late penalty fees.

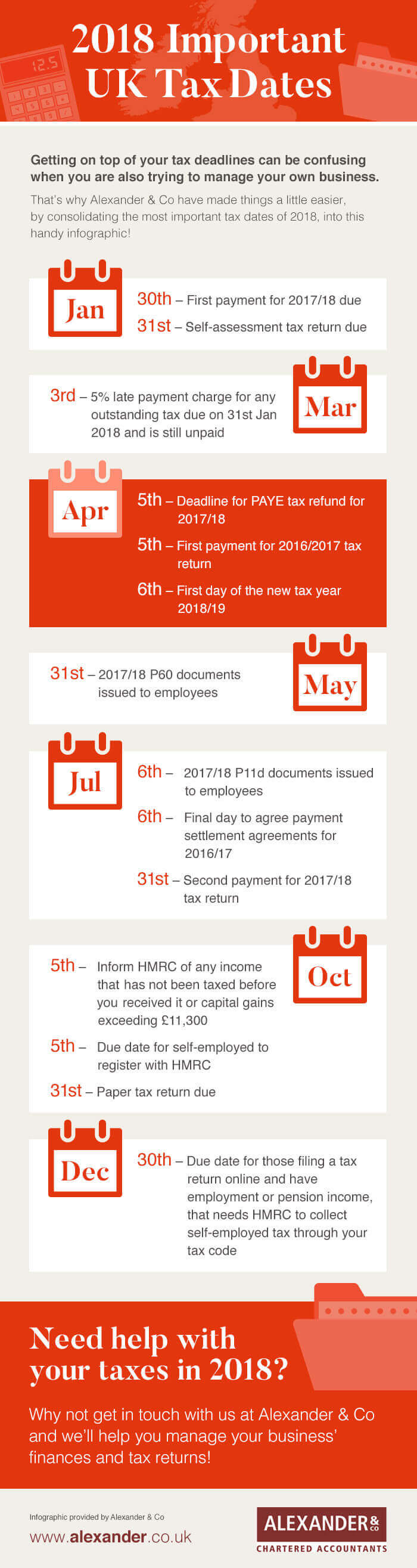

To help, we’ve created a one-stop-shop with all the important tax dates and deadlines for this year. Download the infographic below or read on to learn more information about the key tax dates in 2018.

January

Your deadline for completing your self-assessment tax return is midnight on 31st January 2018. This means that you must complete your self-assessment tax return and complete first payment on your account by this date.

The online self-assessment deadline is also at midnight on 31st January 2018. Therefore, you must have your self-assessment tax return correctly filed in and submitted via the HMRC online service by this date.

March

If you have not submitted your online self-assessment tax return or paid your tax bill by 31st March 2018 (up to 3 months after the original deadline) you will be liable for a £100 fine. After a period of 3 months or longer, the penalties and interest will increase.

April

The 5th April 2018 is the end of the 2017/18 tax year and also the deadline for PAYE tax rebates.

The following day, 6th April 2018, is the start of the 2018/19 tax year; this is the best time to check if your tax codes are correct and up-to-date.

May

31st May 2018 is when P60 documents for the 2017/18 tax year are issued to employees.

July

The deadline for sending a PAYE settlement agreement (PSA) for the 2017/18 tax period is 6th July 2018; after which point you will not be able to apply for a PSA for the aforementioned tax year. P11d and P11d(b) documents must also reach HMRC and be distributed to employees by 6th July 2018.

The 31st July 2018 is the deadline for the second payment of your 2017/18 tax bill.

October

You should register with HMRC by 5th October if you became self-employed; you should also notify HMRC of any untaxed income and capital gains exceeding £11,300 by the same date.

The 31st October is the deadline for those filling out paper self assessment tax returns. The same penalties for late online returns also apply to late paper tax returns.

December

The main tax deadline for December is on 30th December 2018. By this date, those who owe less than £3000 for the 2016/17 tax year should have submitted their online self-assessment tax return.

Contact the experts

If you need help with any areas of tax, it’s best to get in contact with the experts. Our experienced team of tax accountants can help your streamline your tax processes, helping you to save valuable time and money.

[alexander-btn size=”normal” fullwidth=”no” newtab=”no” text=”Get in touch with us” url=”https://alexander.co.uk/contact/”]