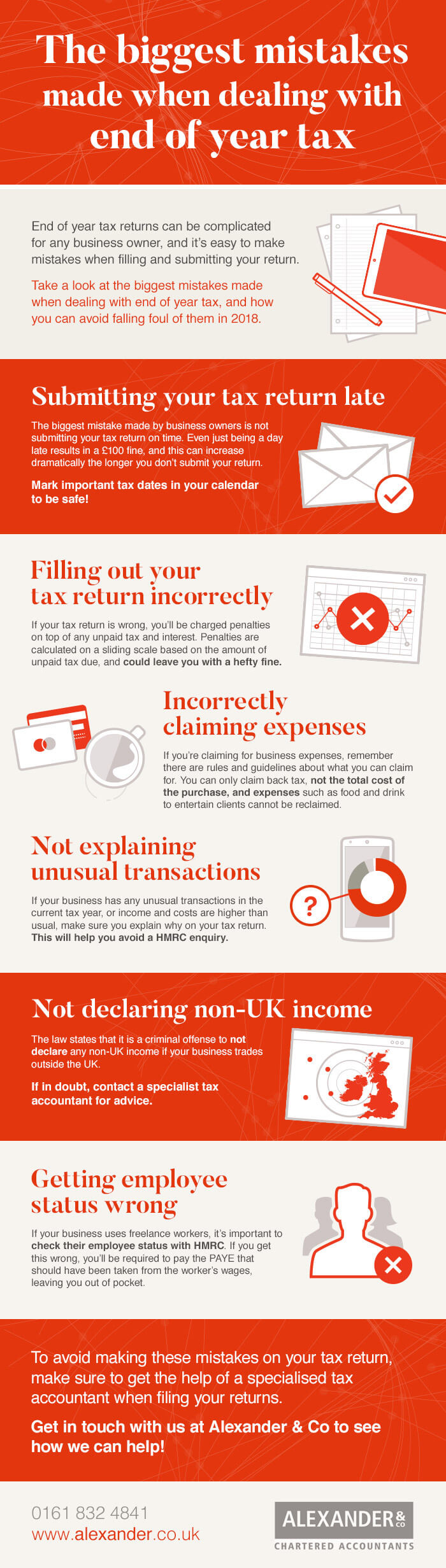

The biggest mistakes made when dealing with end of year tax

End of year tax can be daunting for even the most experienced business owners, and it’s easy to make a mistake on tax returns without even noticing. We’ve put together our list of some of the most common mistakes made when dealing with the end of year tax, and how you can avoid making the same mistakes in the future. Read on to find out more!

Take a look at our end of year tax tips below to help make your end of year tax a breeze.

Avoid costly fines

HMRC penalties for incorrect returns or late submission can quickly add up and leave you out of pocket. The easiest way to avoid these is to make sure you submit your return on time. Take a look at our guide to important tax dates for 2018 and use the helpful infographic to help keep on top of your tax this year.

Penalties are also given on a sliding scale if your tax return is submitted with mistakes, so it pays to double check all the details you’ve entered before submitting!

Beware of claiming for incorrect expenses

Knowing what counts and doesn’t count as a business expense can be a grey area, so it’s worth speaking to a tax specialist to find out what you can claim for. For example, food and drink purchased whilst on a business trip is classed as a business expense, but food and drink bought to entertain clients isn’t!

Make sure you’ve thought about your employees

Following recent high profile news cases with companies such as Uber and Deliveroo, it’s important to have a think about those who work for you. Although you may think you hired freelancers or contractors, HMRC may view these as employees and charge you for any unpaid PAYE. Factors including flexibility of working hours and an obligation to undertake work may influence how HMRC views those who work for you. If in doubt, speak to an employment solicitor for advice.

If you need a helping hand with your business’ taxes, speak to a specialist tax accountant who will be able to help and guide you throughout the whole process. Here at Alexander & Co, our accountants have a huge range of experience and can help your business at any stage in its growth. Contact us today to find out how we can help your business.

[alexander-btn size=”normal” fullwidth=”no” newtab=”no” text=”Contact us today” url=”https://alexander.co.uk/contact/”]