How to spot HMRC Scams and Phishing Schemes by Mail, Online and Social Media

HMRC scam calls, HMRC scam emails and HMRC scam text messages appear to be on the increase again, this time in the run-up to the 31 January self assessment deadline.

The government organisation regularly issues warnings to be aware of fraudsters, especially at key times in the year, including the above self assessment deadline.

Last year, it reportedly received around 144,298 reports from the public regarding suspicious HMRC contact, including emails, texts and phone calls. Many of these were phone scams and it’s thought that around half of all scams reported last year were related to fake tax rebate claims.

This year we have been made aware of people receiving letters through the post from HMRC, with a penalty for not submitting VAT returns.

On careful inspection, the VAT number didn’t match with the person’s VAT number. Whilst these were genuine letters from HMRC, an additional VAT registration had been set up fraudulently, and HMRC confirmed this is very common now. Individuals should always make sure they are checking all details on official letters, including VAT numbers and addresses and should pass such correspondence on to their professional advisors for certainty, rather than reply directly themselves.

Some of the most common techniques used by fraudsters include phoning taxpayers and offering a fake tax refund or pretending to be HMRC by texting or emailing a link which will take customers to a fraudulent page, where bank details and money can be stolen. There are also many incidents of fraudsters threatening people with arrest or imprisonment if a bogus tax bill is not paid immediately.

HMRC operates a dedicated customer protection team to identify and close down scams but it is advising customers to understand the signs to help avoid becoming victims. HMRC and banks will never contact customers asking for their bank details, PIN or passwords. You should never give out private information, respond to text messages, download attachments or click on links in such emails or texts.

Does HMRC call you?

With HMRC phone scams on the rise, as well as HMRC phishing scams, it is important to never give any personal information over the phone if you receive a call, even if the person phoning you claim the call to be regarding HMRC fraud reporting or a HMRC fraud call itself. You may receive an HMRC tax fraud phone call, threatening you. It is always best to hang up, avoiding any potential HMRC fraud calls and check on HMRC’s own website on how to contact directly.

Does HMRC send you text messages?

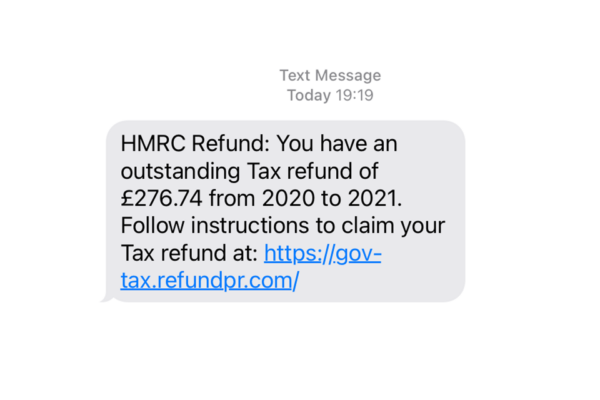

Yes the HMRC will occasionally send text messages, which may occasionally give you a link to click in order to find out more information on the GOV.UK website. If the text claims to be offering a refund or asking for personal financial information, HMRC advises to not click on any links provided or reply to the messages.

The below image shows a scam/phishing example from the HMRC (Source) you can also see from the link that this does not direct to a GOV.UK website. Any links like this should not be clicked on.

There have also been reports of a COVID-19 Refund SMS scam. These text messages again suggest you are eligible for a tax refund from HMRC connected with the pandemic.

WhatsApp HMRC Scams

Much like SMS scams, you may find that you are contacted through WhatsApp in a similar way. You will only receive WhatsApp messages if you have subscribed to the government channel on WhatsApp. You will only ever be sent reminders from HMRC, and again, never a message regarding a refund.

How to spot HMRC Mail Scams

When HMRC send you official letters you’ll see a QR code that sends you to the GOV.UK website, unless stated otherwise in the letter. HMRC states that they will never direct their customers to a web page that asks for them to input sensitive material. If you receive a letter with a QR code that sends you to a non-GOV.UK page, the letter may be a scam and it’s worth calling HMRC directly to check.

You can also check a list of genuine HMRC contact addresses by visiting their official contacts page here.

Spotting HMRC Email Scams

According to HMRC, they will only ever email you about a tax rebate or ask you for personal information from an email address that ends in hmrc.gov.uk. They advise, if you receive any emails from HMRC to double-check the sender address before following the directions in the email. If you receive an email from an email address that does not end in ‘hmrc.gov.uk’, do not click on any links, open any attachments or disclose any personal information to the sender.

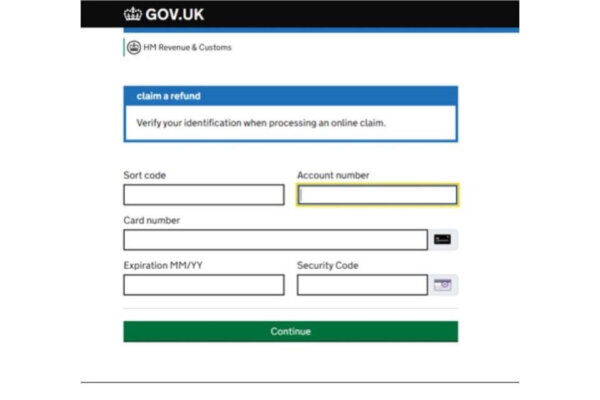

In some cases, fraudsters will have created a webpage that looks similar to the HRMC website. HMRC has provided the following example of the types of phishing websites scammers may use to collect your details.

If you receive an email from HMRC and are unsure whether it’s legitimate, it’s always advised to get all HMRC or log into your HMRC online account directly to check account notifications.

Avoiding HMRC Social Media Scams

In the last year, a number of X (formerly Twitter) scam messages have been reported. HMRC will never contact you about your account or tax refunds through your social media platforms. All contact through social media should be reported. You can do this by making a note of the account name and sending any details and screenshots you can to security.custcon@hmrc.gov.uk.

HMRC scam communications – what to do

“Clients can contact us if they are uncertain about correspondence or calls”

John McCaffery, tax partner here at Alexander & Co explains “We are often contacted by clients who receive fraudulent communications of this nature. Our advice is to never reply directly. Clients can contact us if they are uncertain about correspondence or calls they have received.

“If anyone else is unsure of any communications they receive, they can forward details of suspicious calls or emails claiming to be from HMRC to phishing@hmrc.gov.uk and texts to 60599. More information on how to avoid and report phishing and scams can be found on the HMRC website here.

“Many people delay completing their Self Assessments, leaving them to the last minute. Whilst this can lead to mistakes and errors in rushing to meet the deadline and avoid fines, it also leaves people more vulnerable to falling victim of a fraud attack. Anyone looking for assistance in completing their Self Assessments or for more general tax advice, should contact our tax department without delay.”

Our expert tax team at Alexander & Co can be contacted on 0161 832 4841 or info@alexander.co.uk.